Inflation in the United States has a direct impact on the economy of the place and even the world. The economy of the United States is susceptible to the adverse effects of inflation, which can also impact many elements of everyday life, including consumer purchasing power, company operations, and governmental policy.

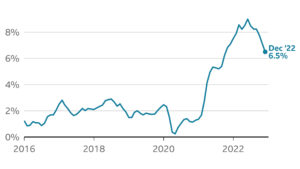

Over the previous 62 years, the Average inflation rate in the United States has varied between -0.4% and 13.5%. The calculated inflation rate in 2022 was 8.0%, representing a significant increase in the average price level of goods and services that year. The average annual inflation rate from 1960 to 2022, the monitoring period, was 3.8%.

In simpler notes about inflation in the united states, imagine that you and I are having a polite conversation, and I want to clearly explain how inflation in the US affects the economy:

Let’s begin with what inflation is?

Inflation generally implies that prices for products and services increase over time. When this occurs, the value of the money in our pockets or bank accounts decreases since we can no longer purchase as many items.

How does this affect us, then? So our purchasing power declines as prices rise. This implies that the same amount of money we had previously couldn’t buy as much.

For instance, if a loaf of bread was once $2, inflation may have increased its price to $2.50 or higher. Because of this, we have to spend more money on necessities, which can be challenging, particularly for those with lower earnings. Interest rates are also impacted by inflation. The government may increase interest rates in order to curb inflation.

The cost of borrowing money increases when interest rates rise. Because loans and mortgages are more expensive as a result, consumers and businesses may spend less. So, increasing interest rates may affect our capacity to purchase a new automobile or a home.

Inflation can also have an impact on saving and investing. Our money may depreciate over time if the rate of inflation is higher than the earnings on our low-risk investments or savings accounts. With high inflation, growing our money is more difficult.

Businesses are also impacted. Inflation-driven price increases for goods and labor may make it difficult for businesses to sustain their profits. Some companies raise prices to pass on these higher expenses to customers, which initiates an inflationary cycle.

The finances of the government might be impacted by inflation. While rising prices may result in more tax income, they still have to pay more for public services and social programs.

Inflation breeds ambiguity. Planning for the future can be difficult for both organizations and individuals when costs increase too quickly or unexpectedly. In such circumstances, long-term agreements and investments become riskier.

Therefore, maintaining control of inflation is essential for a sound and stable economy. The Federal Reserve and the government closely monitor inflation and employ a variety of strategies to control it and encourage economic growth.

Inflation in the United States and economy

Following are a few ways that Inflation in the United States may affect us economy growth:

Purchase power

Consumers’ purchasing power decreases as a result of Inflation in the United States. The standard of life for people and households declines as prices rise because the same amount of money can buy fewer products and services. Lower-income groups may be particularly impacted by this as they may find it difficult to keep up with rising expenditures.

Cost of living

Costs of essential necessities including food, housing, healthcare, and transportation can rise as a result of inflation. Households may find it challenging to cover their regular bills as a result of this putting them under financial strain.

Interest rates

Central banks, such as the US Federal Reserve, may raise interest rates to thwart inflation. Borrowing money may become more expensive when interest rates rise, which may result in a decline in consumer spending and company investment. Additionally, it may have an effect on mortgage rates, making homeownership more expensive for individuals.

Savings and investments

Inflation in the United States may have a detrimental effect on both. The real worth of money may erode over time if the rate of inflation outpaces returns on savings accounts or low-risk investments. To protect their capital, investors may also seek out riskier investments, which can cause market volatility.

Salary pressures

As living expenses rise, employees seek higher pay to keep their purchasing power. This can result in wage inflation, which may raise production costs for enterprises and may cause a spiraling wage-price relationship.

Business Operations

During times of high inflation, businesses may have difficulties. Increased input costs, such as those for labor and raw materials, might reduce profit margins. Some companies might raise their prices to pass on rising costs to customers, creating an inflation feedback loop.

Government spending

Inflation in the United States may have an effect on budgetary matters. The cost of delivering governmental services and social welfare programs may rise along with tax receipts because of increased pricing.

International trade

An economy’s ability to compete can be impacted by inflation. Domestic price increases that outpace those of trading partners may impair export competitiveness and increase import costs, which may affect the trade balance.

The Ending Notes

The economy and people’s daily lives can be greatly impacted by inflation in the United States. The cost of living rises as a result of higher costs for products and services when inflation is high. As a result, families and individuals may have to spend more money on necessities, which reduces their purchasing power.

The Federal Reserve may increase interest rates in an effort to curb inflation, which could result in less borrowing and spending by individuals and businesses.

Conversely, lower interest rates can promote economic expansion. Inflation can also have an impact on investments and savings, making it difficult to maintain the real worth of funds over time.

Overall, controlling inflation is crucial for sustaining a strong and stable economy and safeguarding the welfare of the populace.

What is your opinion about Inflation in the United States?